Wall Street tumbles, returns some of week’s big gains

A person walks past an electronic board displaying the Nikkei 225 stock index at a securities firm in Tokyo, Friday, July 22, 2022. Asian stocks were mostly higher on Friday after another day of gains on Wall Street amid a deluge of news on the economy, interest rates and corporate earnings. (AP Photo/Shuji Kajiyama)

PA

NEW YORK

Wall Street is giving back some of its strong gains for the week on Friday after disheartening readings on the global economy and another round of earnings reports from big US companies.

The S&P 500 was down 1.3% as of 3 p.m. ET and threatened to halt a three-day rally that had taken it to its highest level in six weeks.

The Nasdaq composite led the market lower with a 2.2% decline following weaker-than-expected earnings reports from Snap, Seagate Technology and other tech-focused companies.

The Dow Jones Industrial Average held up better, down 249 points, or 0.8%, to 31,787, largely because constituent American Express gave an encouraging earnings report and said its cardholders were spending more.

Sandwiched between last week’s discouraging inflation report and next week’s Federal Reserve interest rate decision, the S&P 500 is still on course for its best week in a month after a series of corporate earnings reports mostly better than expected.

Falling yields in the bond market also helped, easing pressure on equities after expectations of Fed rate hikes pushed yields higher for much of this year.

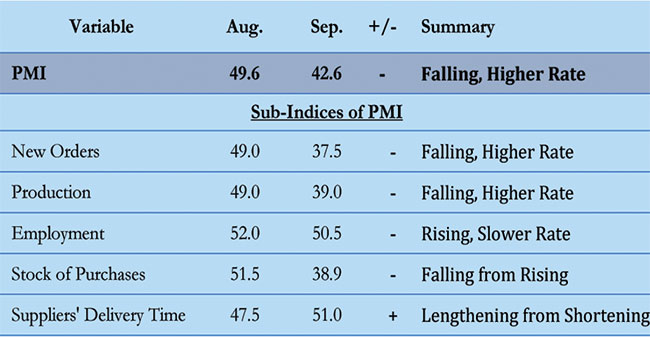

On Friday, the two-year Treasury yield fell again, to 2.99% from 3.09% Thursday night and from 3.14% a week ago, on worries about the economy. A report released Friday morning said business activity in the United States could contract for the first time in nearly two years, with service industries particularly weak.

“Manufacturing has stalled and the rebound in the service sector from the pandemic has reversed as the tailwind of pent-up demand has been overcome by the rising cost of living, rising interest rates and the growing gloomy economic outlook,” Chris Williamson, chief economist at S&P Global Market Intelligence, said in a statement accompanying the survey data.

Similar reports earlier in the morning also suggested weakness in Europe, underscoring the fragility of the global economy as central banks raise interest rates to spur inflation. Higher rates make economic conditions more difficult, and the threat is that overly aggressive hikes could trigger a recession.

Reports follow others from earlier in the week showing that parts of the US economy are slowing more than expected. While this raises the threat of a recession, it also causes traders to push back on their expectations of how aggressively the Federal Reserve will raise interest rates next week. Instead of a full percentage point, traders now see a 0.75 percentage point increase as the most likely outcome.

The 10-year Treasury yield fell to 2.78% from 2.91% on Thursday evening.

In the stock market, the company behind the Snapchat app fell 38.9% after reporting a worse loss and lower spring revenue than Wall Street forecasts.

Snap’s weakness could mean pressure on other ad-dependent tech companies, which are also among the most influential stocks on Wall Street. The parent companies of Google and Facebook are due to release their earnings next week.

Data storage company Seagate Technology lost 8.2% after it said anti-COVID measures in Asia and slowing global economic conditions last quarter affected its results, which came in lower than expected.

Verizon fell 7.7% after its profit fell short of expectations, although its revenue beat expectations. It also cut its profit forecast this year.

On the winning side was American Express, which rose 2.1% after posting a better-than-expected spring profit for the spring. He said customers were spending more on travel and entertainment in April than before the pandemic, the first time it had happened.

The encouraging data reinforced some recent comments from CEOs of major banks, who said their clients appeared to be in good financial shape despite all the worries about inflation and the economy.

HCA Healthcare jumped 12.5% for the biggest gain in the S&P 500 after performing better than Wall Street forecasts. Petroleum service provider

Despite Friday’s declines for Wall Street, the S&P 500 is still on pace for a gain of more than 2%.

Besides the easing of Treasury yields during the week, lower prices for crude oil and other commodities also provided some relief on the inflation front. They come on top of some signals suggesting inflation may be on the verge of peaking, such as easing inflation expectations in the coming years, said Nate Thooft, senior portfolio manager at Wealth Management. Manulife Investments.

“Inflation is the most important thing,” he said. “It’s not earnings, it’s not the Fed, it’s not interest rates themselves. This is the uncertainty of inflation.

“For me, as soon as you see real evidence that inflation is stabilizing and improving, all the other things become less of a problem as well,” he said. The war in “Ukraine is separate and isolated, but all the others are connected, and the epicenter is inflation.”

___

AP Business Writer Elaine Kurtenbach contributed.