Orchid Island Stock (ORC): Does a 15% price drop make it safer?

AnsonLu/iStock via Getty Images

Thesis and background

Since I first published my bearish thesis on Orchid Island Capital (ORC) on August 8, 2020, the stock has lost 14.9% of its price while the overall market has risen around 5%. And the dividend yield held steady at 15.6% due to such a large price drop, even when it had to cut its dividend by 15%. Announced on January 13, 2021, its monthly cash dividend will increase to $0.055 per common share, down 15% from the previous dividend of $0.065.

With a dividend yield of over 15%, ORC may seem attractive to many income-oriented investors, especially in a low rate environment. Also, you may be wondering if the investment has become safer due to lower prices.

Indeed, the risks of investing in a given stock decrease as its price falls – but only when the fundamentals remain the same – a critical caveat. The thesis of this article is that this is not the case with ORC. Even though its price has fallen significantly since my last write, its fundamentals have also deteriorated in the meantime. As a result, risks remained high. And we will look at the following risks one by one in detail later in this article:

- Low and irregular profitability despite high leverage

- Valuation risks

- Risks to pay its current dividends

Alpha data research.

Low and irregular profitability despite high leverage

As detailed in my previous article,

For a financial company like ORC, there are two knobs that management can turn to increase profitability: return on assets (“ROA”) and leverage effect. Through simple calculations, we can show that ROE is just the product of these two things, i.e.,

ROE = ROA x leverage.

Where ROA here is defined as net income divided by total assets and leverage is defined as total assets divided by equity. ROA shows how effectively management operates the asset to generate profits. And leverage is just leverage – it amplifies profits in good times and amplifies losses in bad times.

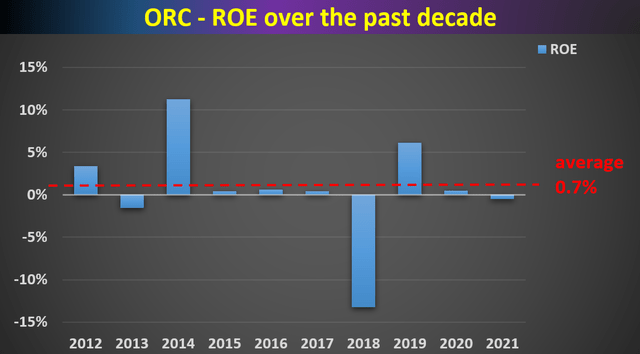

As we will see next, ORC unfortunately did a poor job of turning both knobs. And as you can see in the following graph, its return on equity (“ROE”) has been inconsistent with a meager average of 0.7%. To put things into perspective, an ROE of 10% is generally considered the gold standard for financial institutions. And ORC’s ROE is way off. More importantly, and more alarmingly, its leverage is significantly higher than the industry average at the same time.

author and Seeking Alpha data.

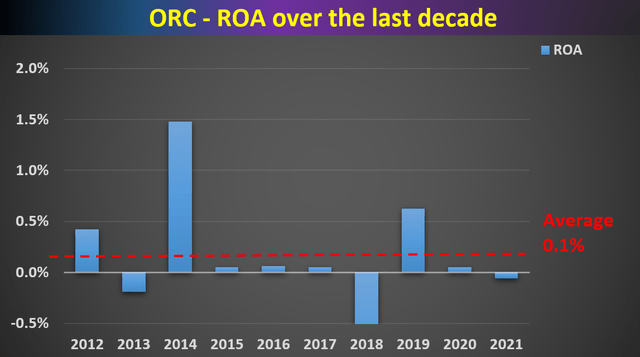

The following table shows the ROA, the first button ROE, for ORC. As can be seen, ORC’s ROA has also been inconsistent and weak, with a historical average of 0.1%. Again, to put things into perspective, an ORA of 1% is generally considered the gold standard for financial institutions. And ORC is still far from this mark.

author and Seeking Alpha data.

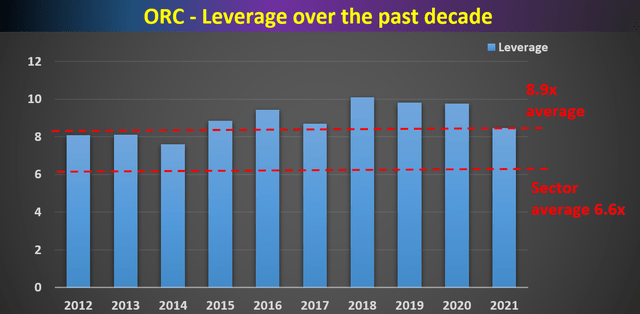

Finally and most alarmingly, ORC’s low profitability persisted despite its use of higher leverage. The following chart shows its leverage. As seen, ORC’s leverage has averaged 8.9x over the past decade, and its current leverage is on par with the historical average.

To put it into perspective, the average leverage ratio for the mREIT industry is only around 6.6x. As a result, ORC’s leverage is 34% higher than the industry average. A substantial amount which makes it much riskier than the sector, especially with the ongoing interest rate hikes according to the latest dot-plot announced by the Fed. And we will detail the interest rate risks later at the end of this article.

Source: author and Seeking Alpha data.

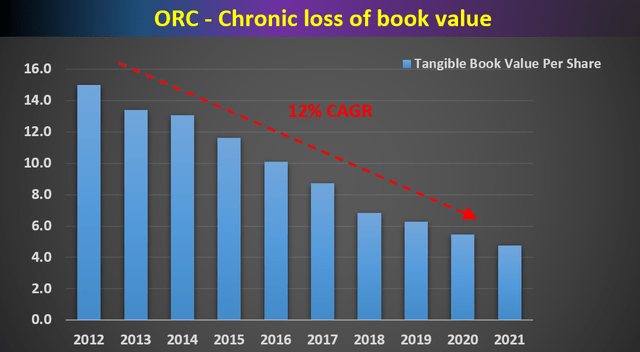

Chronic loss of tangible book value

ORC also suffered a chronic loss of tangible book values (“TBV”), a red flag for mREIT’s business. As the following chart shows, it is losing its TBV at an alarming rate, 12% CAGR since 2012, making it a kind of annuity – with a bad leak – for shareholders.

During the COVID 2020 pandemic, ORC – like all other mREIT players – had to respond by liquidating its mortgage-backed securities and reducing the size of its balance sheet. The liquidation reduced the TBV per share from $6.27 to $5.46 per share, a decline of 12.9%. However, what is really concerning here is that A) this decline is chronic in the case of ORC, and B) many other mREITs have now recouped their TBV losses from the pandemic, but not ORC.

So, in ORC’s case, the pandemic is not the cause of its TBV losses – it simply accelerated it.

Source: author and alpha research

Valuation risks

Despite all the above issues, ORC’s valuation is not cheap by historical standards. As the following chart shows, ORC’s current valuation is around 0.96x its book value. This level of valuation is not only on par with other safer and more profitable stocks in the mREIT sector, it is also at a high level compared to its own all-time high. As seen below, ORC has historically been valued at an average of 0.8 times its book value and the current valuation is a substantial 20% premium above its historical average.

Source: author and alpha research

Interest rate risks and dividend coverage

As mentioned at the beginning, ORC has an above average leverage ratio, which makes it more exposed to interest rate risks. ORC makes its money on the spread between long-term and short-term rates. ORC’s current short-term debt is approximately $5.2 billion. Based on this financial data, the picture of its interest coverage and dividend coverage is quite grim. Just consider some simple numbers:

- Its TTM operating cash flow is approximately $86 million and its net income is negative.

- It will need about $73 million in cash a year just to maintain its current common and preferred stock dividends. Going forward, it will need about $62 million a year to maintain its reduced dividend of $0.055 per share per month.

- With its current loan, a 1% increase in its interest rate would result in $52 million in additional interest expense.

So, at the end of the day, it’s already struggling to cover its debt and dividends at the currently also zero borrowing rate. And a 1% rise in interest rates would force it to cut its dividends, or even worse, make it permanently unprofitable.

Finally, the increase in interest could be more than 1%. The most recent dot chart from the Fed suggests an increase in the fed funds rate to around 1% this year and another 1% over the next one to two years.

Conclusion and final thoughts

Since my last bearish thesis on ORC in August 2020, the stock has lost almost 15% of its price and the dividend yield has jumped to 15.6%. If you’re wondering if it’s gotten safer now, or if you feel drawn to the 15%+ return, you should be aware of the following potential dangers:

1. The stock suffers from low and irregular profitability despite its high debt ratio (more than 1/3 higher than the sector average).

2. Its higher leverage ratio makes it more exposed to interest rate risk. It is already struggling to cover its debt and dividends at the current near-zero borrowing rate. And even a 1% rise in interest rates would force it to cut its dividends, or worse, render it permanently unprofitable.

3. It has suffered a chronic loss of tangible book values – at an alarming rate of 12% CAGR since 2012. With such chronic losses, it amounts to an annuity – with a bad leak – for shareholders.

4. Finally, despite all the above issues, its valuation is actually above its historical average.

Marketplace launch to come

If you liked that, watch us for what’s next! We are launching a Marketplace service in partnership with Envision Research February 1. Mark your calendar. The first 25 annual subscribers will receive a 30% off for life at the best price. We’ll provide a suite of exclusive features (our best ideas, direct access to us for Q&As, model portfolios, etc.) to help you find the optimal balance between short-term income and aggressive long-term growth.