Orchid Island Stock: Massive Dividend Amid Easing Concerns (NYSE:ORC)

anyaberkut/iStock via Getty Images

Orchid Island Capital’s (NYSE:ORC) decision to maintain a high dividend yield amid the pandemic and even into the third quarter of 2021 continues to excite investors. The firming housing market is another addition as house prices seek stability. There has been a significant increase in inflation which reached a record high of 5.4 in the second quarter of 2021. To protect its lofty status as a mortgage-backed real estate investment trust (mREIT), Orchid aims to balance its investments interest rate sensitive with credit sensitive assets.

Thesis

Despite the 52.50% drop in Orchid Island Capital’s share price over the past 5 years and the economic dominance of COVID-19, Orchid’s management hopes to protect its portfolio against the diminishing effects of risk . In this article, I’ll outline why I’m bullish with this undervalued mREIT stock in light of rising total returns.

High dividend yield and tapering effect

ORC’s dividend yield is over 15%, compared to a five-year growth rate of -14.23%. ORC income investors over the past four years have reaped an average return of 17.36% with a percentage difference of 536.11% compared to the mREIT sector.

An income investor in the S&P500 would have had a total return of over 135% over the past 5 years, even though ORC’s stock price has fallen over the period shown. While analysts have downplayed the direct relationship between equity prices and mortgage rate returns, the figure below shows a slight correlation between total interest income returns and equity returns.

Figure 1- S&P 500 price performance versus mortgage market

Industry leader Annaly Capital Management, Inc. (NLY), with a market capitalization of $12.27 billion, has an average dividend yield of 11.97% over 4 years. This return is 338.87% higher than the average return for the sector but nearly 200% lower than the return provided by ORC.

However, inflation is at its peak with many indications that it will continue to rise in the fourth quarter of 2021. Analysts have been heading for an interest rate hike, a move that would negatively impact the bond market. mREIT.

Figure 2- US inflation over one year

Fed chief Jerome Powell insisted that the US central bank would consider cutting and delaying interest rate hikes. With monthly purchases of $120 billion ($80 billion in Treasuries and $40 billion in agency mortgage-backed securities), mortgage market investors may be concerned about the pace of the reduction.

I agree with ORC Chairman and CEO Robert Cauley that the impact on the market will be proportional whether the Fed starts cutting agency MBS or Treasuries. The Fed’s dual responsibility is to stabilize prices and employment numbers. With that in mind, the pace of the cut could be slowed to match any rate hike likely set for 2023.

Wallet covers

In the near term, Orchid is expected to maximize the defensive positioning of its portfolio through 2022. Given its focus on the agency residential mortgage-backed securities (RMBS) market, the company will reduce its investments in portfolios that favor higher rates. and tapered effects.

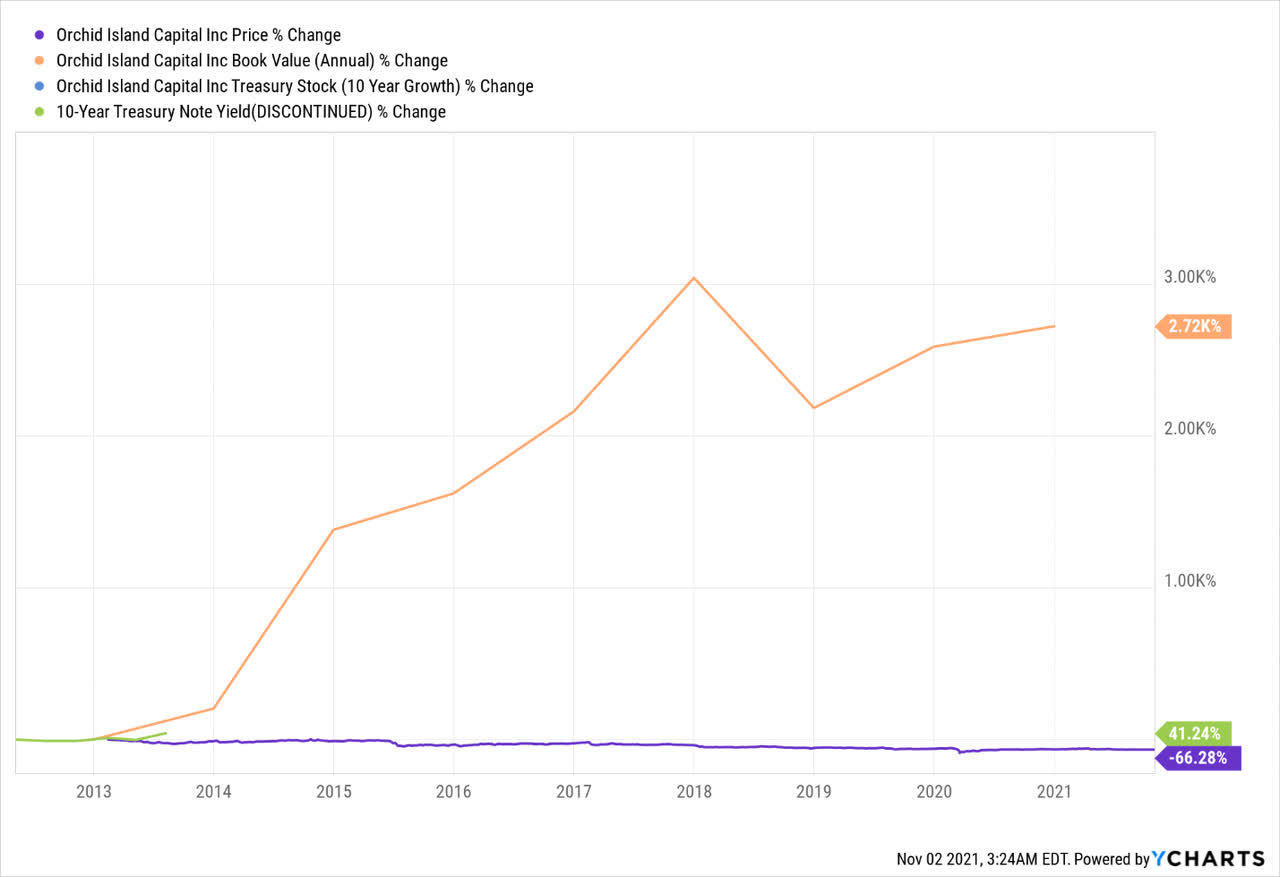

In its third quarter 2021 results, ORC claimed to have minimized its exposure to Ginnie Mae’s fixed rate for RMBS as well as 15- and 30-year production coupons. The company increased its production coupons for the yield on 10-year Treasury bills, which jumped 41.24% since ORC’s inception.

Figure 3- Chart illustrating ORC vs. US 10-Year Treasury Yield

The level of yield on 10-year US Treasuries almost matches the high yield seen since the start of the year in the first quarter of 2021.

Additionally, Orchid increased its capital allocation to Fannie Mae and Freddie Mac with profitable results in Q4 2021.

ORC increased its Fannie Mae portfolio from 73.4% as of December 31, 2020 (representing a fair value of $2,733,960) to 77.0% (a jump in value to $4,315,090) as of September 30, 2021. decrease in the percentage of Freddie Mac’s portfolio from 26.6% to 23.0% during the stated period was offset by the increase in fair value. Quarter-over-quarter, the mortgage relay portfolio (PT RMBS) decreased by 3%, from 82% to 79% in the third quarter of 2021.

This decrease has been attributed to reduced investment in Ginnie Mae’s agency which involves riskier unconventional facilities such as FHA, VA and USDA loans. On the other hand, Fannie Mae purchases home loans from major commercial banks. Understanding this concept brings us to the demand and supply of agency RMBS as the country prepares for the drawdown in early 2022 or Q4 2021.

Refinance Affordability

The Federal Housing Finance Agency (FHFA) has extended refinance programs to people with incomes at or below 100% of the area median income bracket (AMI). The program which included Freddie Mac and Fannie Mae was expanded from 80% AMI earners to 100% AMI to accommodate low-income earners.

During the announcement, Freddie Mac said the expansion would help deserving homeowners take advantage of the low-mortgage environment. Thanks to the Refi plan (introduced in August 2021), low- and middle-income homeowners can save between $100 and $250 per month thanks to low interest rates and mortgage payments.

For its part, Fannie Mae has added provisional requirements on the eligibility of owners of Condo and Coop projects. In its lender letter (LL-2021-14), Fannie Mae said the requirements would protect borrowers from unstable projects and help the agency manage risk for lenders and investors.

To recap, Freddie Mac intends to expand borrower eligibility from 80% to 100% AMI employees. Other than that, the agency will remove the requirement to pay at least a monthly payment of $50. However, to make this happen, borrowers will still be required to reduce their monthly payment by a reasonable amount as well as reduce their interest rate by at least 50 basis points or 0.50%.

Also, the removal of the $5,000 cap on funded closing costs and the 10-year maximum seasoning requirement should be immediately affected. On the supply side, this logistics is likely to increase the number of homeowners by lowering eligibility levels and thereby increasing demand for homeownership through agency MBS.

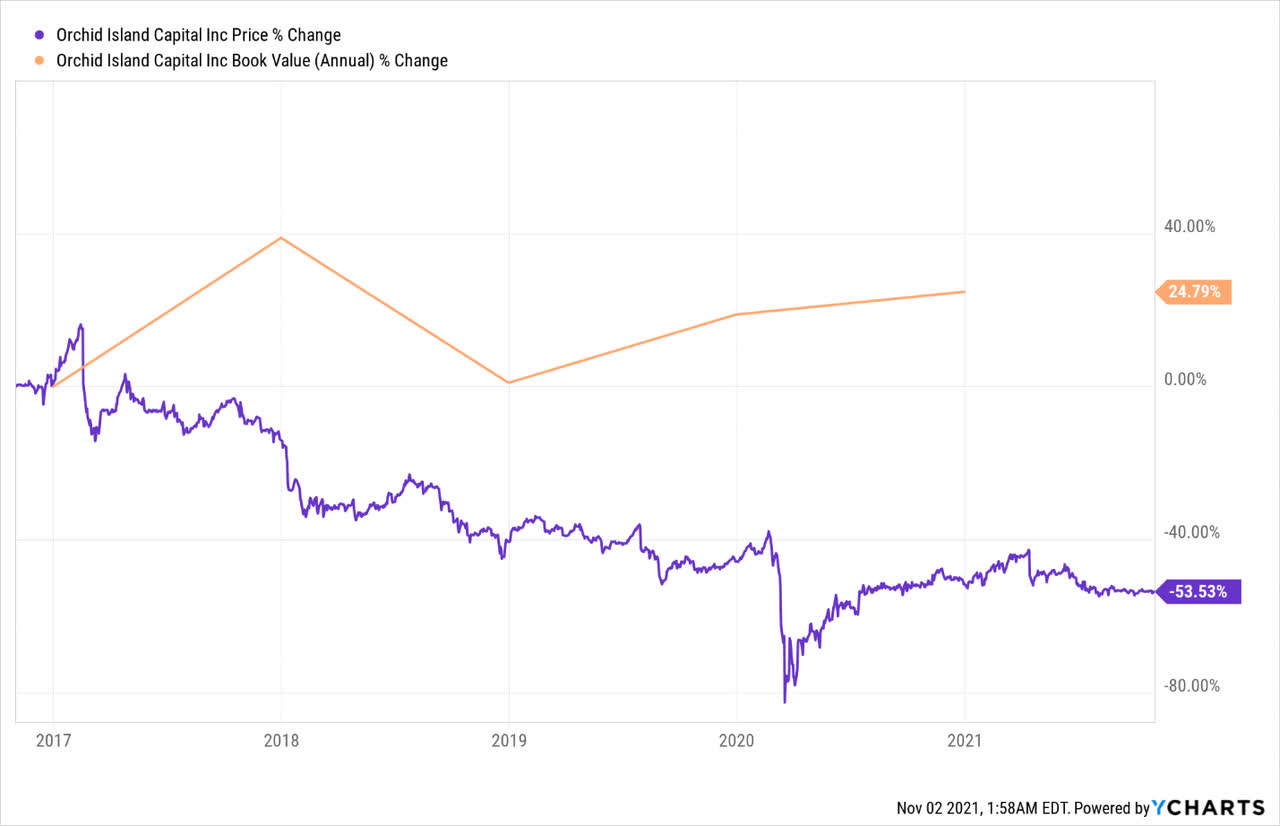

Positive book value

As of September 30, 2021; Orchid Island Capital increased its book value per common share by $0.06 to $4.77. In the second quarter of 2021, the book value was $4.71. Over the 5 years, ORC’s annual book value increased by 24.79% despite a 53.53% decline in share price.

Figure 4- ORC price vs. book value over the last 5 years

The positive change in book value as it appears on the balance sheet indicates that the company is undervalued because it is above market value.

ORC’s price-to-book ratio is 1.04, showing that the stock price moves in line with book value. From this point of view, it is considered quite valued but indicative of growth prospects along the way.

Income investors also believe that ORC has solid prospects, including growth, expansion and increased profits.

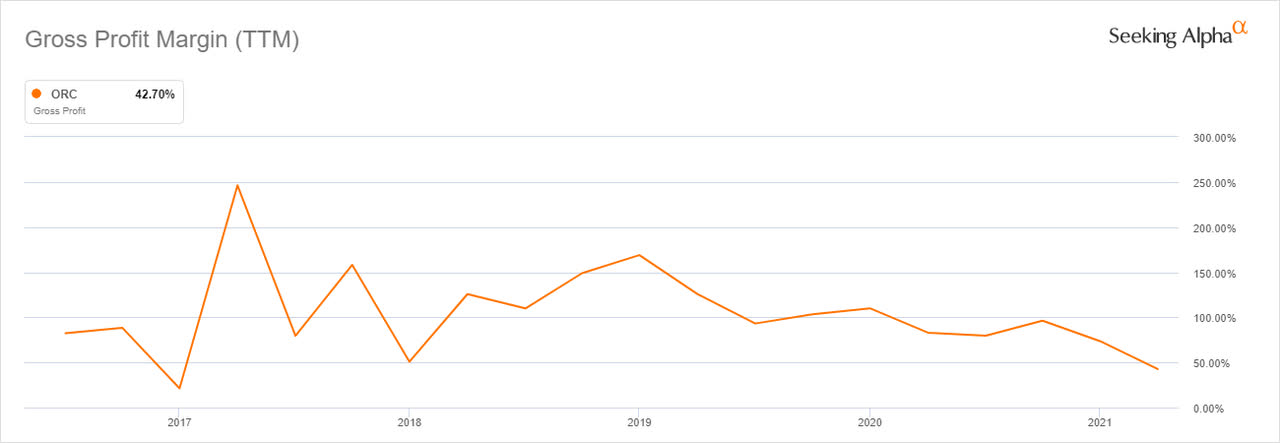

Figure 5- ORC gross profit over 5 years margin (TTM)

Orchid Island Capital still saw a 42.70% increase in gross profit margin through 2021. Net interest income (QoQ) jumped 17.79% from $27.7 million ($0.28 per common share) to $32.6 million ($0.28 per common share). The company was able to replace its net loss of $16.9 million in Q2 2021 with net income of $26.0 million, signaling a strong quarter heading into 2022.

As an income investor, I’m intrigued by ORC’s total return, where it gained 5.4% in Q3 2021 from a dividend of $0.195 (per common share). The same dividend in Q2 2021 saw the total quarterly return fall 0.7% from a $0.23 reduction in book value.

Figure 6- ORC’s total rate of return of its portfolio compared to its peers

Since its inception in 2013, only the 4-year average total return has shown a decline which is also supported by an 11.5% reduction in average peer return levels.

Conclusion

Orchid’s share price decline is insufficient to provide a complete picture of ORC’s stock performance. By visualizing the increase in total returns and adding other metrics such as dividend yields, portfolio performance, and distributions associated with capital gains, we can see that investors are getting value for their investments. Additionally, ORC’s interest income as an mREIT increased nearly 18% in Q3 2021, after a net loss of $16.9 million in Q2 2021, which proved to be an incredible rally. until 2022. In my view, ORC investors will be shielded from the downside effects as the company tones. reduce its rate-sensitive portfolio. On the supply side, mortgage lenders Fannie Mae and Freddie Mac (where ORC invests heavily) are doing a good job of bringing in low-income people and expanding mortgage lending. For these reasons, I am optimistic with ORC.