Orchid Island Capital Stock: Be Careful With Dividend Yield (NYSE:ORC)

Thesis and background

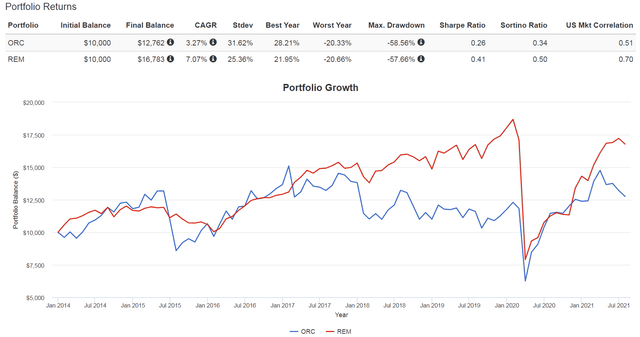

Orchid Island Capital (ORC) shares currently offer a dividend yield of over 15%. However, potential yield-driven investors need to be aware of the potential dangers, be it valuation or quality. In terms of valuations, the stock is actually quite expensive, as revealed by both its price relative to its tangible book value and its yield spread.

In terms of quality, the stock may struggle to sustain the current dividend level in the near future. The stock has had a very turbulent year during the pandemic. The stock has lost around 12% of its tangible book value and nearly half of its operating revenue in 2020. Since then, the price has recovered significantly and is close to pre-pandemic levels. But there is little improvement in tangible book value, and revenue-generating capacity is far from fully restored. At this point, the price movement has been way ahead of the fundamentals. And the margin of safety is really slim at the current price.

Overview

ORC is an mREIT company. It invests in residential mortgage-backed securities (“RMBS”) in the United States. The Company’s RMBS is backed by single-family residential mortgages. The entire mREIT industry has been hit very hard during the COVID crash due to the uncertainty and risks in residential and commercial mortgages. And ORC was no exception. In these difficult times, ORC had to respond by liquidating its mortgage-backed securities and reducing the size of its balance sheet. The stock has lost approximately 12% of its tangible book value (“TBV”) per share and nearly 60% of its stock price during the pandemic, as shown in the chart below. The liquidation of a significant part of TBV has reduced its ability to generate income. Operating revenue declined from approximately $94 million per pandemic to approximately $55 million in 2020, a decline of 42%. To put that into perspective, the cost of the dividend is around $60 million so far in 2021.

Since then, the price has recovered significantly and is close to the pre-pandemic level. But there is little improvement in tangible book value, and revenue-generating capacity is far from fully restored. At this point, price movement has been well ahead of fundamentals, as explained in more detail below.

Source: Author, with simulator from Portfolio Visualizer, Silicon Cloud Technologies LLC

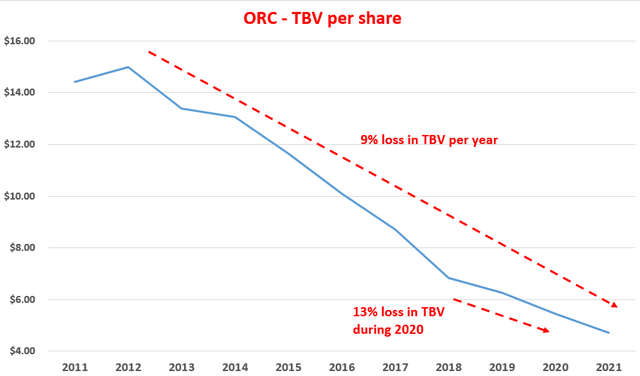

Analysis of tangible book value

As mentioned above, during the pandemic, ORC had to respond by liquidating its mortgage-backed securities and reducing the size of its balance sheet. As shown in the chart below, the sell-off reduced the TBV per share from $6.27 to $5.46 per share, a decline of 12.9%. What worries me the most is that such a decrease is chronic in the case of ORC. As can be seen, the TBV has been in continuous decline since 2012, at a rate of 9% CAGR. The pandemic has just accelerated it.

Source: author and Seeking Alpha data.

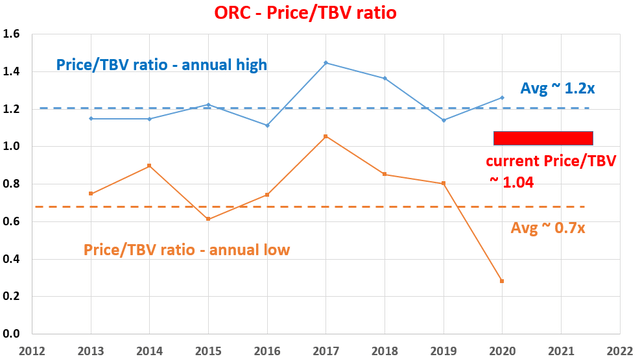

The price is now at the pre-pandemic level. But there is little improvement in tangible book value and operating income has not fully recovered either. And therefore, at this point, the price movement has been well ahead of the fundamentals, as the following chart shows. This graph shows the annual highs and lows of the price/TBV ratio over the past few years. As seen, the yearly highs are between ~1.1x and 1.4x, with an average of 1.2x. And the yearly lows are between 0.6x and 0.9x, with an average of 0.7x.

Currently, the price/TBV ratio is at 1.04, close to all-time highs, again because price movement has been well ahead of fundamentals recovery.

Source: author and Seeking Alpha data.

Yield Spread Analysis vs. BAA Bond

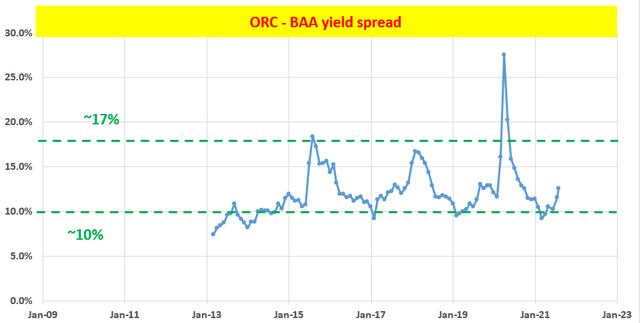

Another way to assess the margin of safety is to look at the yield differential between the ORC and a high-yield index, and here I’m using Moody’s Seasoned BAA Corporate Bond Yield. The following chart shows the ORC yield spread versus the seasoned yield of Moody’s BAA corporate bonds. As can be seen, the yield gap is bounded and manageable. The gap was between about 10% and 17% most of the time. Which suggests that when the spread is near or above 17%, ORC is significantly undervalued relative to corporate bonds in general (i.e. I would sell BAA corporate bonds and buy ORC). And when the yield gap is close to or below 10%, it means the opposite. The basic reason is that the yield spread measures the risk premium that investors are willing to pay for ORC relative to other assets such as BAA bonds.

Such yield analysis provides a useful indicator for assessing short-term investment risks and opens up opportunities for dynamic allocation to benefit from short- to medium-term price movements, as shown in the chart below.

Source: author based on Seeking Alpha and Fred Data

The following chart shows the next 1-year total return on ORC (including price appreciation and dividend) when the purchase was made with a different yield spread to the BAA bond. As can be clearly seen, this is initially a positive trend, indicating that the probability and amount of total return increases as the return spread increases. The correlation coefficient is 0.35, suggesting a positive correlation.

For readers unfamiliar with the correlation coefficient, it is a number between -1 and 1. When equal to 0, it indicates that there is a correlation between two variables (in this case , yield spread and yield, respectively). And 1 indicates a perfectly positive linear correlation between two variables. A number near or above 0.75 is generally accepted as an indication of strong correlation. And in this case, the correlation is 0.35, suggesting a positive but moderate level of correlation.

In particular, as shown in the orange box, when the deviation is around 17% or more, as mentioned above, the total returns over the next year are all positive and have all been quite large (until about 70%).

At the time of this writing, the yield spread over BAA is 12.6%, as shown, near the thin end of the historical spectrum, again suggesting that this was not a good entry opportunity for short term market timers (at least relative to a high yield bond index such as the BAA corporate bond).

Source: author based on Seeking Alpha and FRED data

Conclusion and final thoughts

Orchid Island Capital shares currently have a dividend yield of over 15%. However, potential yield-driven investors need to be aware of the potential dangers, be it valuation or quality. Specifically,

- Currently, the price/TBV ratio is at 1.04, close to all-time highs, as price movement has been well ahead of the recovery in fundamentals.

- Additionally, at the time of this writing, the yield spread over the BAA bond index is 12.6%, near the thin end of the historical spectrum, indicating high investment risk relative to to high yield bonds.

- The stock may struggle to sustain the current dividend level in the near future. TBV is in continuous chronic decline and the pandemic is only accelerating it. TBV is the source of income for mREIT companies. With the decrease in TBV, the ability to generate income also decreases.

Thanks for reading ! And I look forward to hearing your thoughts and comments.