Lessons for Sri Lanka on SOE Reforms – Singapore’s Temasek Holdings – The Island

Introduction

A super-holding company for the management of state-owned enterprises (SOE) has been identified as a global success model for the management of state-owned enterprises. This model allows the government to take a more independent approach to SOE operational decision-making, relieving it of direct responsibility for overseeing all SOEs dispersed across various industries and redirecting its budget and energy somewhere else. The merits of this model have enabled countries like Malaysia and Singapore, which have similar holding structures, to deliver impressive performance from their state-owned companies.

This article is the first in a three-part series where parts one and two provide an in-depth analysis of the case of Singapore and Malaysia’s SOE holding company models (Singapore’s Temasek Holdings and Malaysia’s Khazanah Nasional), and their role in economic growth and development for the respective countries. Part III will provide lessons for Sri Lanka that can be adopted for the country’s SOE reform process. This series of articles is a joint effort of the Ceylon Chamber of Commerce (CCC) and the Colombo Stock Exchange (CSE).

Part One: Temasek Holdings of Singapore

Insight

Temasek was incorporated in 1974 under the Companies Act of Singapore to hold and manage assets previously held by the Government of Singapore. The purpose of transferring assets to a commercial company was to free the Ministry of Finance from responsibility so that it could focus on its primary policy-making and regulatory role, while Temasek would own and manage these companies. corporations (also known as government-linked corporations – GLCs) on a commercial basis.

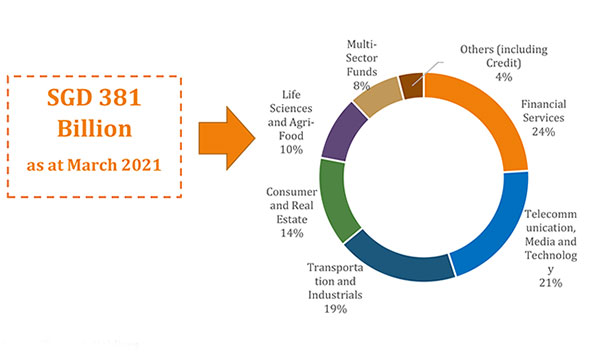

Like any commercial company, Temasek has its own board of directors and a professional management team. It pays taxes to the government and distributes dividends to its shareholders. Temasek was established to contribute to Singapore’s economic growth by transforming entities into world-class businesses through effective management and strategic business investments. Today, it operates in 9 countries and the value of its portfolio stood at SGD 381 billion at the end of March 2021. This equates to approximately USD 283 billion, or approximately 6 times Sri Lanka’s external debt accumulated over the years. years and about 4 times. the amount of Gross Domestic Product (GDP) of Sri Lanka.

Temasek invested primarily in Singaporean companies in its early days, but has become a major global investor in recent years. Geographically, the majority of these investments are in China (27%), followed by Singapore (24%), America (20%) and the rest of the world (12%). Temasek operates a diversified portfolio spread across many segments such as financial services, telecommunications, media, technology and transportation and industrials. Please refer to Figure 01 for a breakdown of sectors.

Source: Temasek Holdings

Why did Temasek succeed?

State-owned enterprises are generally considered inefficient businesses due to political interference and corruption. Despite this, various studies have shown that Singaporean SOEs show higher valuations than non-SOEs even after controlling for company-specific factors and also have better corporate governance practices.

This is due to the political, social and economic context that Singapore faced during the period of self-rule until the early years of independence, from the late 1950s to the early 1970s. to a difficult political environment in Singapore during this period played an important role in the development of good political governance in Singapore, which was then transferred to public companies in Singapore with good corporate governance practices. Temasek’s corporate governance framework covers the following broad areas:

1. Board governance

Temasek aims to help public companies create effective boards by establishing guidelines on appropriate board composition, director tenure, size, and the formation of specialized board committees.

2. Commercial charters

Temasek encourages SOEs to stay focused on their core competencies and will not frown on SOE diversification if it is in the best interests of its shareholders.

3. Talent and Compensation

Temasek encourages public companies to recruit the best global talent and reward them competitively.

4. Value creation

Temasek works closely with their public companies to adopt appropriate performance criteria to maximize shareholder returns. He expects his companies to be profitable and to generate a high rate of return on investment, like any shareholder.

Consequently, the management of Temasek has enabled public companies to create value for their shareholders. This led to public companies posting higher valuations on average than non-public companies, even after controlling for company-specific factors such as profitability, leverage, company size, the sector effect and foreign ownership.

How has it contributed to development goals?

Temasek is a government holding company that acts as a shareholder on behalf of the Singapore government (Ministry of Finance). It pursues its development mandate by buying direct stakes in global companies, primarily in Singapore and Asia, then reinvesting proceeds from asset sales and dividend income into overseas assets, acting as a capital fund. -investment.

The government’s independent approach has enabled Temasek’ to manage its funding and exercise its independence. Temasek has received no regular government funding in its nearly 50-year history, but does receive occasional injections from time to time, which are made public.

The compounded annualized total shareholder return since its inception in 1974 is 14% in Singapore dollars. The Temasek Foundation oversees 23 nonprofit philanthropic projects and has positively impacted 1.5 million lives in Asia and Singapore through its community work.

Contribution to reserves

In terms of contributions to the Singaporean economy, the Singapore government can include approximately 50% of Temasek’s expected long-term returns, as well as investment returns from the Government of Singapore Investment Corporation (GIC) and the Singapore Monetary Authority. Singapore (MAS). These three institutions contribute to government reserves through the Net Investment Returns Contribution (NIRC). The NIRC includes up to 50% of the net investment returns (NIR) on the net assets invested by GIC, MAS and Temasek, and the net investment income (NII) from the past reserves of the remaining assets.

The full dossier can be viewed at: Holding Company for SOEs: Learnings for Sri Lanka.