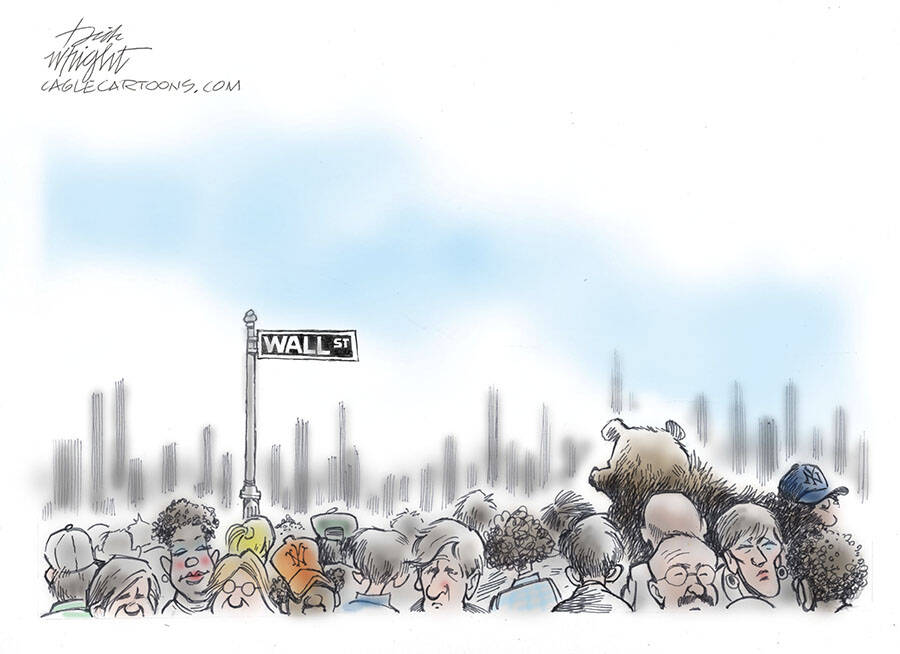

It’s a bear trying to figure out the stock market

Should you invest in the stock market now or wait? This is the difficult question that money experts discuss.

Stock prices continue to fall and NASDAQ.com says what’s “even more irritating is that no one knows how long this downturn will last or how far prices will fall before the market bottoms out. and begins to recover”. “Confusing” is well said.

I have a modest little nest egg that I want to invest in stocks, but I’m not brave enough to see it dwindle if the market continues to fall – even though I know my nest egg will eventually grow in the long run. I don’t claim to understand the many factors that drive the stock market up and down, and this economic stuff has always confused me.

At Penn State, my economics professor thought I was a jerk.

Purcell: A rapidly growing economy is good, sir, because then we can all get rich!

Professor: Rapid growth causes inflation, you idiot!

Purcell: A low unemployment rate is great because it means everyone can have a job!

Professor: Low unemployment can lead to pressure on wages, which causes inflation, you gaffe!

Believe it or not, I got a B-plus in the class. For each question, I simply gave the opposite answer to what I thought was the correct one.

Today’s global economy is truly confusing. It’s all hopelessly connected in a way even geniuses don’t quite understand. Inflation is out of control in the United States thanks to debt and government spending, so the Federal Reserve will raise interest rates to suppress it, which could slow the economy, which can hurt the market fellow – or something like that.

A dictator invades Ukraine, causing a shortage of fertilizers, causing food prices to skyrocket because farmers see declining crop yields – or something like that.

All I know for sure is that American cars are built with engines made in Mexico, bumpers made in Brazil, ignition systems made in Taiwan—and then they’re assembled in Canada. You want an American car, buy a Honda. They make them in Columbus, Ohio.

And all this intertwining of international investments means that anything that happens anywhere in the world can make or break our stock market, which will impact the day I can finally retire. We are now flirting with an official bear market, a period in which stock prices fall 20% or more from a recent high. The Dow Jones Industrial Average is just 15% down, but the tech-heavy Nasdaq index is down 30% from its all-time high.

And the S&P 500, which is seen as a barometer of the health of U.S. businesses, briefly fell into bearish territory last week before recovering slightly. NASDAQ.com wisely suggests that people nearing retirement age may want to wait a bit before retiring, as bear markets can be especially painful for retirees trying to live off their stock portfolios by decrease.

The Wall Street Journal reports that the S&P 500 has fallen an average of 36% during bear markets dating back to 1929, so things could get even worse.

Either way, here’s what gets on my nerves: Depending on how good my current investment is, I’ll spend my retirement years flipping burgers or sipping toddy at a Caribbean resort – and I’ll probably end up do both.

So what is my investment plan? If I ever figure out which is the right one, I’ll take my economic wisdom from Penn State and make the reverse investment.

Tom Purcell is a humorous author and columnist. Email him at Tom@TomPurcell.com.