Capital of Orchid Island: Well, not terrible (NYSE: ORC)

It’s time to put an end to the shorts.

SixFootSwede/iStock via Getty Images

Few things have provided more delight and accuracy than predicting that investors should dump Orchid Island Capital (NYSE: ORC) before they collapse.

We have everything we could want:

- Several quarters of the book value are criticized.

- A consolidation of shares.

- Dividend cuts.

It’s a bear’s dream come true.

However, today we are going neutral on ORC. That doesn’t mean we expect them to come back over $23 (where they started the year). We are not stupid. Going neutral simply means that the risk/reward ratio that justified being bearish before is no longer in place. We are not going to hit stocks with bullish odds, but we will end bearish ones.

Looking for Alpha

The stocks were absolutely clubbed. Price down more than 50% since the start of the year. This makes sense given the reduction in book value and dividends as well as the general level of fear in the market. However, the worst has already happened. The Bear Case Happened. It’s the damage. It’s here, in the course of action, already.

On Friday, our estimate of BV per share was around $13.70. Our service has generally performed very well on BV estimates across the industry. We will have occasional misfires, but we are setting the bar for accuracy. If this estimate is correct, the price-to-book ratio is around 0.86. That’s not a huge deal, given ORC’s tendency to lose book value faster than a kid can lose a phone at the pool. However, this is a big enough safety margin that the risk/reward ratio is no longer firmly against investors. I vividly remember telling investors to get rid of ORC before the price-to-book ratio crashes. I remember it like it was last month. Maybe because it was? I have highlighted the actions of 3 High Yielders to Dump After an Epic Rally.

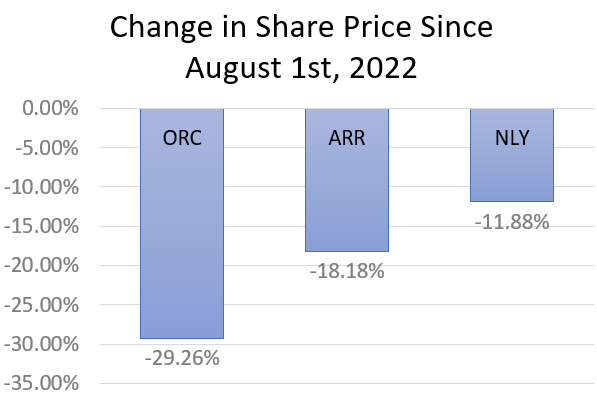

We cited three REITs in our ratings of 08/01/2022:

Looking for Alpha

How have ORC, ARR and NLY performed since then? Here is the graph:

Return on investment

It was a good call to be bearish. To be fair, ORC and ARR paid monthly dividends to cushion this blow. So it’s something. Not much compared to the decline in the share price, but it is Something. Something small.

Why neutral today?

The negative events we anticipated have largely occurred. Of course, the dividend could be reduced again in the not so distant future. If you’re assuming a 16.7% dividend yield is safe, I can’t help you. However, the most obvious cut has already happened.

The price-to-book ratio went from an absolutely absurd premium to a deep discount for booking.

The decline in book value included a dramatic widening of agency MBS spreads (vs. Treasuries), which is better for capital reinvestment. Some investors expect spreads to widen significantly following the Federal Reserve’s plan to reduce exposure to agency MBS as it pushes the economy over a cliff.

However, we expected the spreads to widen before this event. This has happened, with agency MBS spreads widening significantly since the start of the year. We cannot say precisely to what extent these gaps will widen. However, a mortgage REIT that closed all positions today (to clean up the books) would have impressive profits. If they opened new positions (buying assets and entering into interest rate swaps), they would show very impressive net interest margins. This can be a problem as the liquidity of fixed rate and lower coupon MBS pools decreases significantly. The liquidity of the new MBS is much stronger. However, expected returns at market prices should remain comparable.

What investors are seeing now are mortgage REITs posting lower asset yields on assets trading well below face value, compared to new assets at much higher yields. The damages are already recorded in the book value, but they still affect the results.

Since the spreads between agency MBS and treasury bills have increased so dramatically, the remaining book value may be more productive. Yet many investors won’t see it. They will only focus on the benefits from the pass-through of historical costs. It’s a challenge for investors across the industry to understand and it’s a challenge that maybe I’ll prepare a few articles to explain further.

Book value today

We don’t expect the third quarter of 2022 to be a great quarter. Thanks to recent movements in interest rates and spreads, we expect further losses in book value for the third quarter of 2022. Our current estimate (as of Friday) had forecast a BV of $13.70. That’s down from around $14.35 (adjusted for reverse breakdown) since the end of Q2 2022.

This value will change again by the end of the quarter, but it gives investors an idea of the current valuation.

Conclusion

Orchid Island Capital was misplaced. They were losing book value due to widening Treasury spreads and rapidly rising rates. They needed a dividend cut and a reverse split. Despite these issues, “investors” decided to pay a premium to book value even though there were (in my opinion) safer peers available at significantly lower price-to-book ratios. The consequence of investors overpaying for the ORC was a substantial drop in the value of their portfolio. This is usually what happens when investors overpay.

As severe as ORC’s losses were on a fundamental basis, they weren’t as severe as the stock price decline. Due to a large swing in the price-to-book ratio, we are revoking ORC’s downgrade. Investors who were shorting ORC would be advised to withdraw their gains and walk away. However, I’m not ready to suggest buying stocks (other than closing short) just yet. The risk is always high, but the potential reward is also high. It’s a relatively balanced picture. He could fall further, or he could straighten up.

It’s not “no opinion”. This ends a monstrous bearish call that has seen ORC repeatedly caught behind the stake. He tells investors who waited until this week to panic that they are far too late and tells investors to short the stock to capture alpha and change their focus.